Společnosti M&G a Dai-ichi Life Holdings v pátek oznámily, že se dohodly na dlouhodobém partnerství, v rámci kterého Dai-ichi plánuje koupit přibližně 15% podíl ve společnosti M&G a obě společnosti si kladou za cíl dosáhnout v příštích pěti letech nových obchodů v hodnotě 8 miliard dolarů.

M&G se stane preferovaným partnerem Dai-ichi v oblasti správy aktiv v Evropě. Partnerství by mělo přinést 6 miliard dolarů nových toků pro M&G a 2 miliardy dolarů pro Dai-ichi.

Polovina toků M&G bude pocházet z rozvahy Dai-ichi, zbytek ze společného vývoje a distribuce. Nejméně 3 miliardy dolarů budou investovány do strategií M&G s vysokým alfa koeficientem.

Očekávané nové obchody Dai-ichi v hodnotě 2 miliardy dolarů budou pocházet z investic do vlastních produktů a produktů vyvinutých ve spolupráci s M&G.

Společnosti také plánují zvážit distribuci produktů M&G v Japonsku a Asii, vývoj nových produktů a spolupráci v oblasti životního pojištění v Evropě a Japonsku. Budou také zkoumat možnosti společných investic do nových kapacit v oblasti správy aktiv.

The EUR/USD currency pair continued to trade higher on Wednesday. Overall, there is no need to search long for the reasons. Since the start of the week, the market has been reacting to a single event — the new trade confrontation between Trump and the European Union, which began against the backdrop of Trump's claims on the island of Greenland, which belongs to Denmark. As of yesterday, nothing has changed, and even on Tuesday, there was no significant news on this topic. However, the market has sold the US dollar for three days in a row, and it is absolutely justified.

In our view, it is completely irrelevant how and with what outcome the "Battle for Greenland" ends. It is quite possible that there will be no battle at all. Already, some European officials are ready to hand over the Danish island to avoid spoiling relations with Trump and new tariffs. Attitudes toward such a stance may vary. On the one hand, Greenland is not particularly needed by Denmark and, even more so, by the EU. Today, Trump deemed it necessary to seize Greenland; tomorrow, he may deem it necessary to take entire countries under his control. This is not a joke: last year, the US president demanded that Canada join the United States. And when refused, he responded with tariffs.

Therefore, to put it as simply as possible, without political epithets, Brussels itself seems not to understand what it is doing. It has two paths. The first is escalation — responding blow for blow. If Trump imposes new tariffs and threatens to seize Greenland by force, then Brussels must respond in kind. Only then will the world respect Europe. The second is de-escalation — another truce and an attempt to negotiate. Europe could strike a deal with Trump under which it would avoid higher trade tariffs but cede a huge part of its territory. It does not matter on paper who it remains with. If Trump begins to build military bases there, develop mineral resources and oil, Europeans will have nothing to do there, neither now nor in 50 years.

As for the currency market's reaction to what is happening in 2026, we, as before, believe the dollar will only fall. It does not matter which path Europe chooses in the fight for its territories. Even if the conflict ends peacefully, investors will continue to divest from US assets. Of course not massively and not panically, but they will. And the EU is one of the largest creditors of the US. The dollar will also remain out of favor with traders because the level of uncertainty under Trump is off the charts. Another confrontation with the EU, with which a trade deal was concluded last year, is by far not the only factor putting pressure on the US currency. Throughout Trump's first year in office, the list of reasons for the dollar's decline has only grown. Therefore, we continue to expect only an increase in the EUR/USD pair.

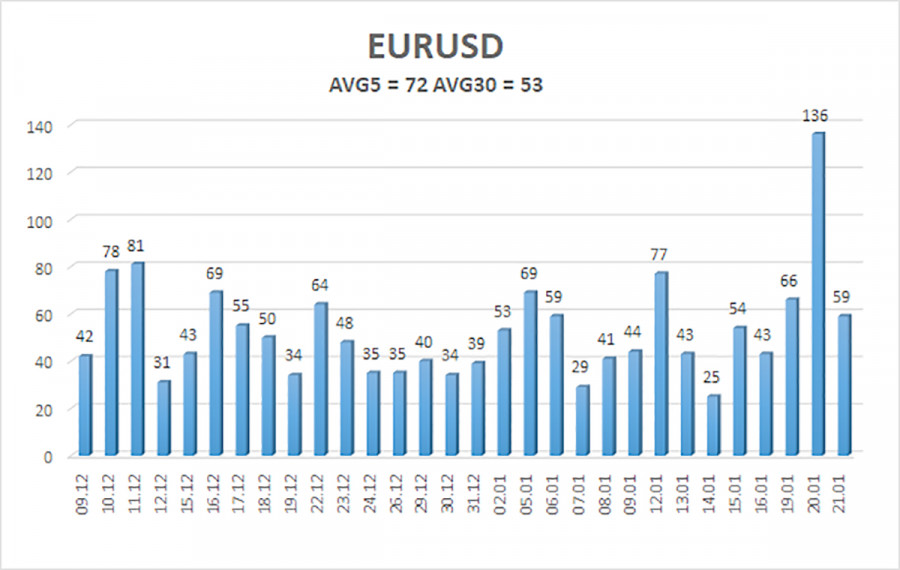

Average volatility of the EUR/USD pair over the last 5 trading days as of January 22 is 72 pips and is characterized as "medium." We expect the pair to move between 1.1628 and 1.1772 on Thursday. The higher-linear regression channel is directed upward, but in fact, a daily-timeframe flat (sideways) continues. The CCI indicator entered oversold territory this week, indicating a downward retracement. However, the key moment remains the flat on the daily TF.

S1 – 1.1658

S2 – 1.1597

S3 – 1.1536

R1 – 1.1719

R2 – 1.1780

R3 – 1.1841

The EUR/USD pair remains below the moving average, but the uptrend is preserved across all higher timeframes, while on the daily TF, a flat has persisted for 7 months. The global fundamental backdrop still matters greatly to the market, and it remains negative for the dollar. Over the past six months, the dollar has occasionally shown weak gains, but only within a sideways channel. It has no fundamental basis for long-term strengthening. With the price below the moving average, small short positions can be considered on purely technical grounds with targets at 1.1597 and 1.1536. Above the moving average line, long positions remain relevant with a target of 1.1830 (the upper line of the daily TF flat).