Scheduled Maintenance

Scheduled maintenance will be performed on the server in the near future.

We apologize in advance if the site becomes temporarily unavailable.

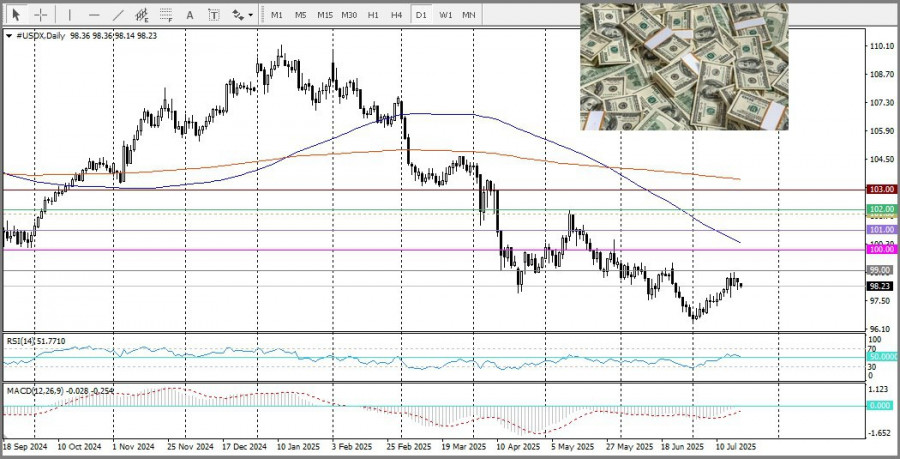

At the start of the European session on Monday, gold showed a positive tone, but the price continues to trade within a multi-week range. The US dollar, retreating from its monthly highs after dovish comments last week by Federal Reserve Board Governor Christopher Waller, is contributing to support for the precious metal.

In addition, concerns about the potential economic consequences of import tariffs introduced by US President Donald Trump have become another factor pushing the safe-haven metal higher for a second consecutive day.

However, market participants believe that the Federal Reserve may delay rate cuts due to signs that Trump's tariffs are impacting inflation by affecting consumer prices. This creates a favorable backdrop for the dollar, restraining traders from aggressive gold buying, as the metal has yet to show significant upside momentum. Therefore, it would be prudent to wait for confirmation of a sustained upward trend via a breakout from the multi-week range before preparing for new long positions, especially given the absence of important US economic data on Monday. Nonetheless, fundamental factors remain generally supportive of further gains in the yellow metal.

From a technical perspective, today's price increase met strong resistance at the upper boundary of the multi-week range around $3365. A decisive breakout above this barrier would act as a key trigger for bulls, potentially lifting prices toward the $3400 round level. Positive momentum could then continue, targeting the next key resistance near $3450.

On the other hand, support is located at $3324, where the 50-period Simple Moving Average (SMA) lies, followed by the psychological level of $3300. Further selling below the monthly low in the $3280–3282 level would open the way for deeper losses, pulling the price toward the June low. Failure to defend these levels would tilt the bias in favor of the bears.

Scheduled maintenance will be performed on the server in the near future.

We apologize in advance if the site becomes temporarily unavailable.