The calendar of economic events in the UK is practically empty. There are a few economic reports, but none of them are labeled as "important." Overall, I agree with other analysts and economists: the final business activity indices for August are unlikely to be of much interest to the market. Apart from these, perhaps only the report on retail sales volume changes for July, which will be released on Friday, stands out. On Friday, however, the market's attention will be focused on the US labor market and unemployment data.

Therefore, it is already clear that the amplitude and direction of the British pound's movement next week will depend on the US dollar. We will discuss US events separately. In this review, let's once again analyze possible wave scenarios.

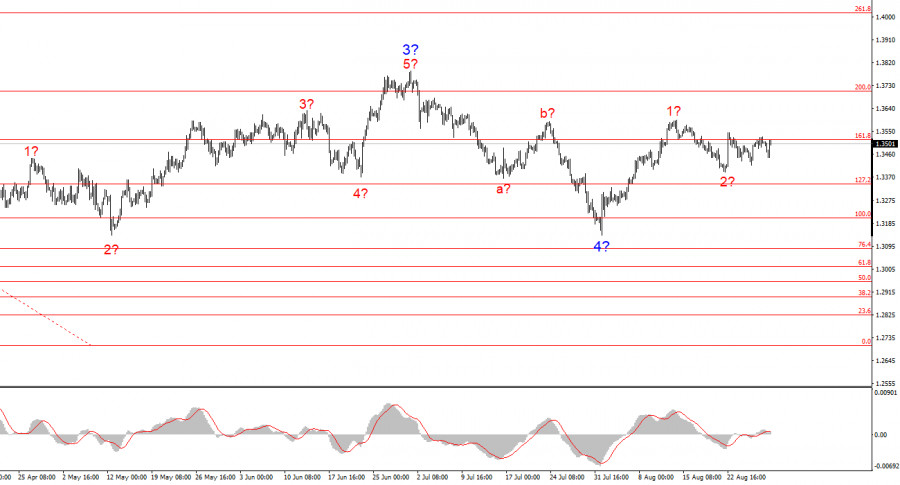

The pound has built a convincing three-wave downward structure within a bullish trend segment. Even if the overall wave count is wrong, we have seen a three-wave correction; therefore, a new impulsive trend segment has begun. If this is indeed the case, by the end of its formation, the pound's quotes will be above the 1.40 level. The first two waves of the new trend segment are obvious: we saw good growth followed by a pullback, indicating waves 1 and 2 within wave 5.

Based on all of the above, the wave pattern suggests only an increase for the instrument. However, I should remind you that a strong news backdrop could break the wave structure. If US reports are strong, there will be higher demand for the dollar, and GBP/USD (as well as EUR/USD) will head lower, which would, at a minimum, complicate the anticipated wave 2 within 5. Ideally, this scenario should be avoided, but it remains a possibility.

Theoretically, even the entire wave 4 could become more extended and complex—a-b-c-d-e. In that case, the pound could retreat to the 1.30 area. Therefore, US reports must not significantly exceed market expectations.

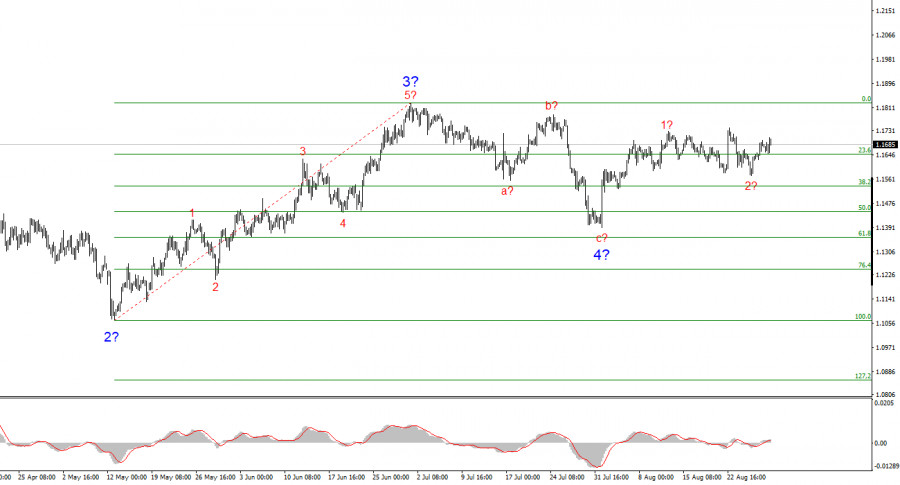

Based on my EUR/USD analysis, I conclude that the instrument continues to form a bullish trend segment. The wave pattern remains entirely dependent on news flow linked to Donald Trump's decisions and US foreign policy. The trend segment's targets may extend all the way to the 1.25 level. Therefore, I continue to consider buying with targets around 1.1875 (which corresponds to 161.8% on Fibonacci) and above. I assume wave 4 construction is complete. Accordingly, now remains a good time for buying.

The wave pattern in GBP/USD remains unchanged. We are dealing with a bullish, impulsive segment of the trend. With Donald Trump, markets could face many more shocks and reversals that might seriously affect the wave picture, but for now, the main scenario remains intact. The bullish trend segment now targets the 1.4017 area. At present, I believe the corrective wave 4 is complete. Wave 2 in 5 may also be done. Accordingly, I recommend buying with a target of 1.4017.