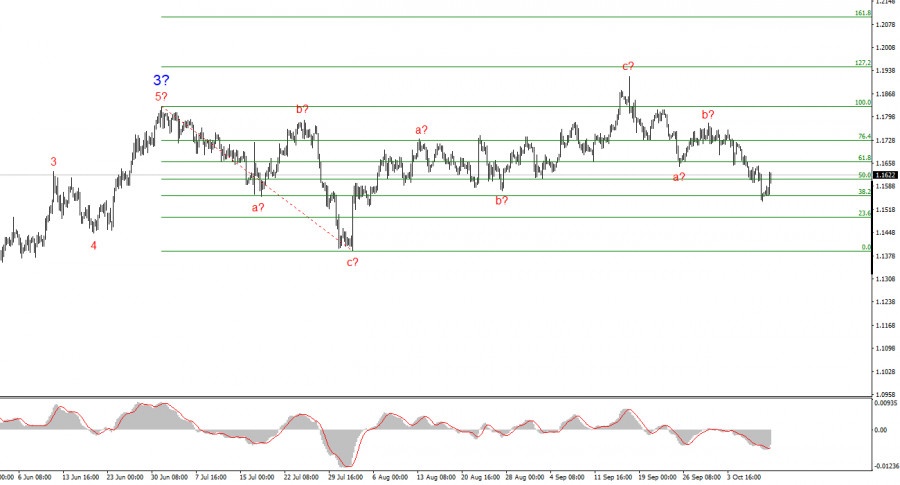

The euro continues to develop a third consecutive three-wave structure, suggesting that the instrument's decline may be nearing completion.

Of course, any corrective structure can become more complex at any moment, because it is the market participants—not wave theory—that ultimately determine the direction of movement. However, if we consider only the simplest wave patterns (as I always emphasize), we are already observing the absence of a clear trend and the presence of a three-wave correction. Consequently, a resumption of the upward trend may begin as early as next week.

The news backdrop also favors continued strengthening of the euro. It is worth noting that for most of 2025, the market has been reacting primarily to U.S. news, with European developments fading into the background. For example, the market showed little to no reaction to the European Central Bank's easing of monetary policy. Over the past two weeks, the market has either been preoccupied with forming a wave-based correction or has been ignoring news from the U.S.—and most likely, both.

To be fair, the U.S. dollar could have weakened over the last two weeks. However, the decline in the euro has complicated the wave structure, which is never a favorable scenario for traders.

Upcoming Economic Reports in Europe

In the new week, the following reports are expected from Europe:

From this relatively short list, only industrial production may generate any notable market reaction. European Central Bank President Christine Lagarde is also scheduled to speak. However, she has already delivered six speeches over the past two weeks. Her core message—that further monetary policy easing is not needed—has been fully conveyed to the market.

Thus, the European news background will be weak. The U.S. side, meanwhile (looking ahead), remains limited due to the ongoing government shutdown. Nonetheless, the market will continue to monitor American developments closely, as there will still be key events worth paying attention to.

According to the analysis of EUR/USD, I conclude that the instrument continues to develop an upward segment of the trend. The wave layout still entirely depends on the news background—particularly Trump's decisions—and the foreign and domestic policies of the new White House administration.

The targets of the current trend segment may extend up to the 1.2500 mark. At present, a correctional wave 4 is forming and approaching its completion, although it is taking on a complex form. The bullish wave structure remains valid.

Therefore, I am continuing to consider only buy opportunities in the near term. By year-end, I expect the euro to rise toward the 1.2245 level, which corresponds to the 200.0% Fibonacci extension.

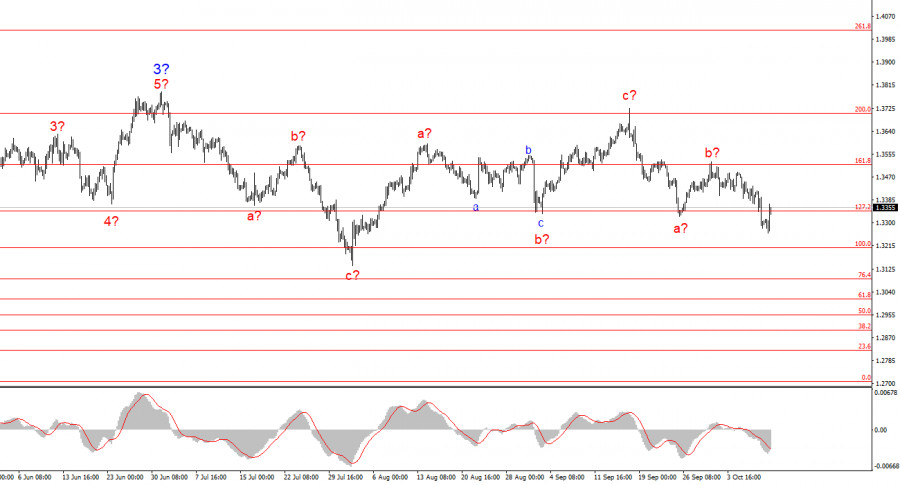

The wave structure of GBP/USD has changed. We are still dealing with an upward, impulsive segment of the trend, but its internal wave formation is becoming more complex. Wave 4 is taking the form of a complicated three-wave correction, and its length is significantly greater than that of wave 2. As we are currently observing the formation of a presumed wave within another corrective three-wave pattern, it may soon be completed. If this is confirmed, the upward movement of the instrument within the global wave framework could resume, with initial targets around the 1.3800 and 1.4000 levels..

1.Wave structures should be simple and easy to understand. Complex structures are difficult to trade and are prone to change.

2.If there is no confidence in the market situation, it is better not to enter the market.

3.One can never have complete certainty about market direction. Always use protective Stop Loss orders.

4.Wave analysis can be combined with other types of analysis and trading strategies.