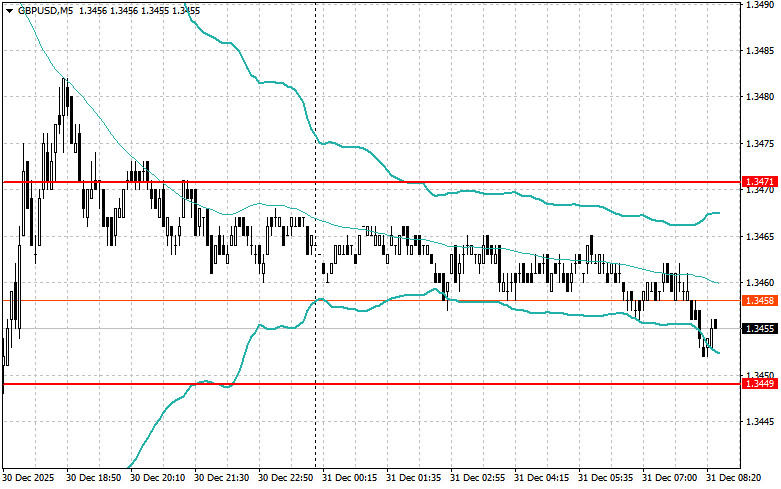

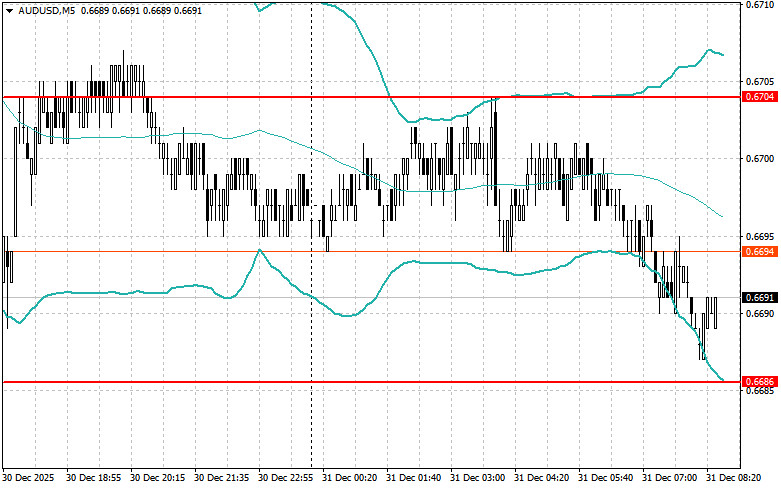

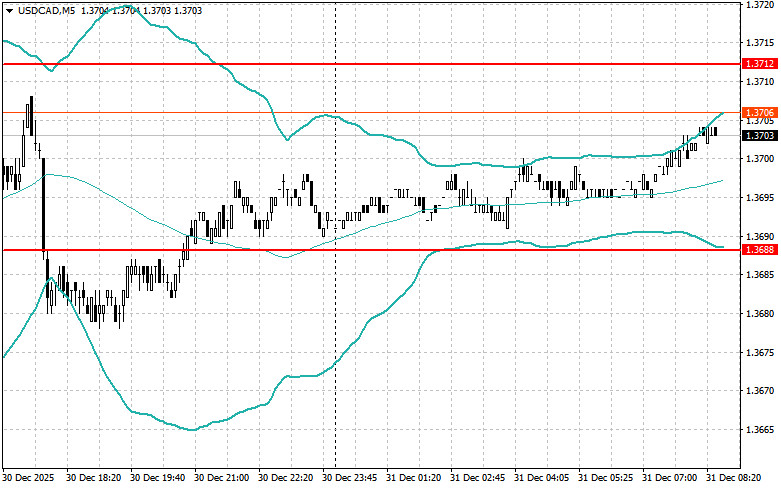

The euro, the pound, and the Japanese yen have weakened sharply against the U.S. dollar.

Support for the U.S. dollar provided by strong readings in the U.S. house price index and the Chicago PMI is undoubtedly an important factor affecting the current dynamics of the currency market. However, the key point will be the Federal Reserve's reaction to these data. If the Fed sees these figures as confirmation of the resilience of economic growth and inflation, it may return to a cautious policy stance, thereby supporting the dollar. On the other hand, the data are not so strong as to draw conclusions on their own, so the committee's stance is unlikely to change on that basis alone.

Today, pressure on the euro and the pound may persist, since there is no statistical data in the first half of the day. The lack of fresh economic information leaves traders reliant on external factors and prior data. Also, bear in mind that today is December 31, and a few participants are likely to want to intervene significantly in the market. In any case, sharp moves in either direction cannot be ruled out, as any unforeseen events can force traders to act.

If the data match economists' expectations, it is better to act using the Mean Reversion strategy. If the data turn out to be much higher or lower than economists' expectations, the Momentum strategy is preferable.