The ECB did not raise interest rates, but the euro strengthened on Thursday. The single currency is testing its highest level in three months and may show its best performance since March 2020.

The Bank of England decided to tighten monetary policy and the European Central Bank did not follow suit, but the euro outperformed the pound by four times in Thursday's trading. The weakness of the British pound can be explained by the fact that the likelihood of a rate hike in the UK has already been priced in the quotes, in addition, a 25 basis points rate hike was for many investors insufficient tightening, some predicted a more aggressive scenario. Notably, the Bank of England by its signals did not justify the hopes of the market, which cannot be said about the rhetoric of the ECB.

The head of the European Central Bank Christine Lagarde during a press conference after the meeting finally admitted that the situation in the euro area is really alarming. Inflation at the moment is at an exorbitantly high level and has been going on for quite a long time. We should admit that Lagarde's statements were quite expected. Sooner or later, the European Central Bank would have had to admit that the price pressure in the eurozone was too high. However, no matter how it was, few expected the sharp hawkish rhetoric of the regulator so soon, especially if we remember the recent comments of Lagarde that the ECB has no urgent need to repeat the actions of the Fed. The ECB surprised the markets, and that is a fact.

At the time of writing the EUR/USD pair rose by 0.21% to $1.1460. Against the background of an unexpectedly sharp change of the ECB policy, the euro is going to show the largest increase since March 2020.

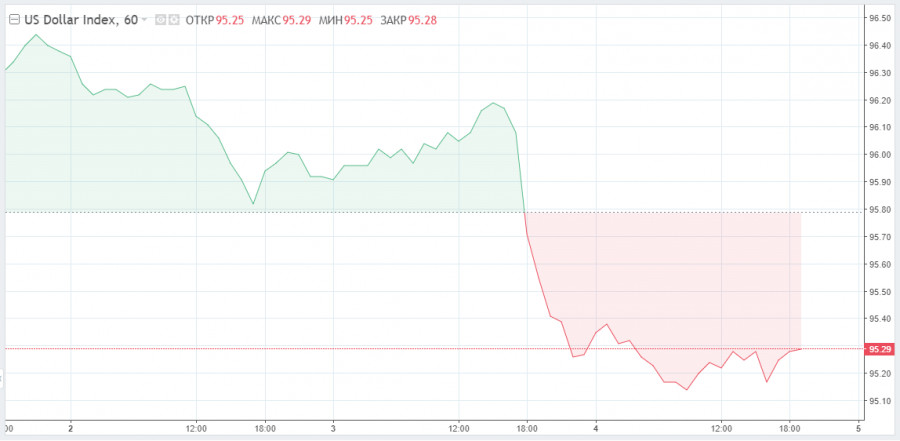

The US dollar weakened on Friday amid a strong rise in US futures, which made investors' need to invest in safer assets disappear.

The US dollar index, which tracks its exchange rate against six major currencies, fell by 0.09% to 94.28 on Friday.

As we can see, demand for the currency may return if the market receives a signal about the policy changes. The market today is already full of expectations of a rate hike from the ECB by December and by at least 50 basis points. What matters is not just when central banks are going to implement their policy tightening, but how quickly and for how much they may raise rates. From now on, this applies not only to the Fed but also to the Bank of England, the ECB, and even the Reserve Bank of Australia.

US market data for January will be released today, which could shake up the US dollar and stock prices. This data will signal to investors and traders how much policy tightening by the US Federal Reserve will be active and how much inflation is entrenched in wages. In addition, the jobs data will help determine if the US economy is losing momentum or not.

According to the latest consensus of market analysts, the data will show an increase in employment by about 110,000 (in December the figure was at 199,000). By the way, at the beginning of the week, 165,000 were expected, but later the information was corrected.

If the data show a decline in employment, it will be much harder for the Fed to implement a sharp tightening of monetary policy. However, if it becomes clear that wage growth has accelerated, the Fed will simply have no choice but to make every effort to cool down economic and business activity.

Optimistic employment and average hourly earnings data are likely to boost the dollar. If it becomes clear that wage growth has slowed down and job creation is sluggish, the dollar may fall into correction after hitting 1.5-year highs recently.