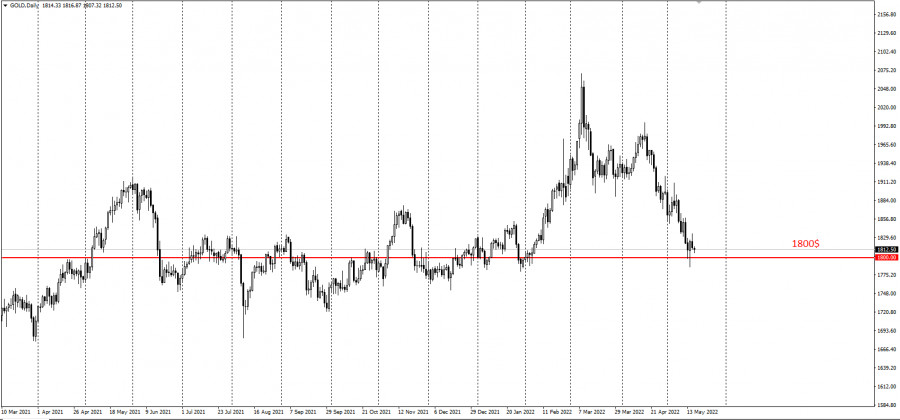

The latest reports on the US economy surprisingly did not have an effect on gold as prices continued to hold above $1,800 per ounce.

Retail sales in the US was reported to have risen 0.9% last month, after a revised 1.4% growth in March. This is in contrast to the forecast of economists, which is a 1.0% increase in the April data.

At the same time, core sales, which exclude auto sales, beat expectations and rose 0.6% last month, compared to a forecasted 0.4% growth.

The gold market did not show strong reaction to the mixed data, founding support at $1800 instead, where traders fixed their short positions.

CIBC Senior Economist Andrew Grantham described the latest retail sales report as solid, adding that it supports the idea that the economy can hold its own against further aggressive rate hikes by the Fed. He noted that the decrease in household income caused by inflationary pressures still does not have a significant impact on spending, which remains well above preliminary levels. This justifies a further 50 basis point rate hike at the next Fed meeting.

Paul Ashworth, chief economist at Capital Economics, also expects the Fed to continue raising rates by 50 basis points.