The EUR/USD currency pair maintained an upward trend throughout Thursday. It is very good that the bulls did not back down from their intentions after Trump issued another pardon. At the moment, there is little official, verified, and confirmed information available.

During the forum in Davos (where he, by the way, arrived late, but the king can do that), Donald Trump stated that he reached agreements regarding Greenland with NATO Secretary General Mark Rutte. And we are left with one question: since when does Secretary General Rutte have jurisdiction over Danish territories? There are several possible answers to this.

Rutte may have discussed potential locations for U.S. military bases and air defense systems on the island of Greenland that do not contradict NATO standards with Donald Trump. Since Denmark is a NATO member, this option seems quite logical and fair. However, if that is the case, then why was Trump insisting on buying the entire island? What stopped him from simply negotiating with the Europeans about placing military bases on it? Especially since Europe and the U.S. are NATO allies.

The second option is that Trump agreed to anything with Rutte, but Copenhagen knows nothing about it, and Brussels will simply block the deal. In our view, Trump wants to acquire the huge island for geopolitical purposes while also establishing control over all natural resources, which are surely worth hundreds of billions of dollars beneath the snowy territory. That is why he offers a million dollars to each resident of Greenland if they vote for joining the U.S. in a referendum (who will allow this referendum to happen?). What does 75 billion mean for America? This is exactly why Trump insists on purchasing the island rather than just leasing it for various military facilities. To place even 10 military bases, an area of 2.166 million square kilometers is clearly not needed.

Thus, first of all, there is no official information about the agreements, and secondly, we highly doubt that the matter has been resolved so easily and simply. However, Trump has canceled his decision to implement additional tariffs on the EU and the UK countries, effective February 1. According to him, the agreement regarding Greenland has been reached, so the tariffs are no longer necessary. Remember? "Trump always chickens out." Of course, not always in practice, but quite often.

Trump clearly calculates all possible moves and the consequences of any of his actions. Or perhaps, it is not just him who calculates but a whole team of analysts, economists, and political scientists. If "the juice is worth the squeeze," then Trump makes a forward move. If potentially his next initiative may cause far more losses than gains, Trump... bluffs. Imagine a simple situation. Trump threatens to raise tariffs by 500% on China if it does not cease its attempts to take over Taiwan. If Beijing is scared, great. If not, well, that's okay. China won't be intimidated; the European Union or some smaller "fish" might be.

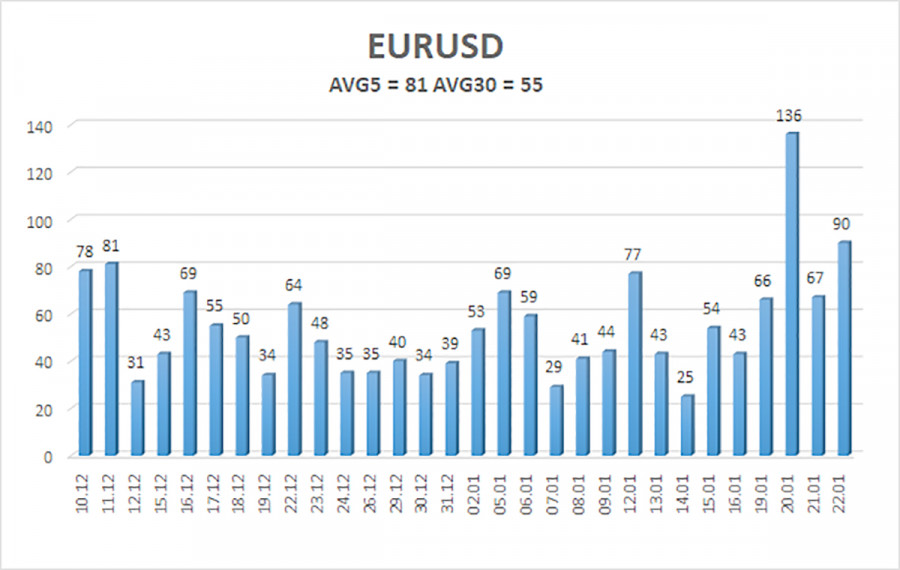

The average volatility of the EUR/USD currency pair over the last five trading days as of January 23 is 81 pips, which is considered "average." We expect the pair to trade between 1.1664 and 1.1826 on Friday. The higher linear regression channel is directed upward, but in fact, a flat has still been in place on the daily timeframe. The CCI indicator has entered the oversold area this week, indicating a downward pullback that may already be complete. The key point remains the flat on the daily timeframe.

S1 – 1.1719

S2 – 1.1658

S3 – 1.1597

R1 – 1.1780

R2 – 1.1841

The EUR/USD pair remains below the moving average, but on all higher timeframes the upward trend persists, while the flat has persisted on the daily timeframe for 7 months. The global fundamental backdrop remains highly significant for the market and remains negative for the dollar. Over the past six months, the dollar has occasionally shown weak growth, but exclusively within the sideways channel. For long-term strengthening, it lacks a fundamental basis. With the price situated below the moving average, small short positions can be considered with targets at 1.1597 and 1.1536 on purely technical grounds. Above the moving average line, long positions remain relevant with a target of 1.1830 (the upper line of the flat on the daily timeframe).