Yesterday, the price of gold fell following the release of convincing data on the US labor market, which reduced expectations of an imminent Federal Reserve interest rate cut. On Thursday, gold dropped by 0.8% after rising by 1.2% in the previous session.

According to reports, the number of jobs in the US increased the most in over a year, and the unemployment rate unexpectedly dropped in January, indicating stability in the American labor market at the beginning of 2026. Strong US employment figures, exceeding economists' forecasts, became a key factor in investor sentiment. A robust labor market generally signals economic resilience, which could push the central bank to maintain its current monetary policy, including keeping interest rates higher for a longer period. This typically makes non-yielding assets, such as gold, less attractive than more profitable instruments, such as bonds or deposits.

Diminished expectations of Fed rate cuts usually correlate with a strengthening US dollar. A strong dollar, in turn, makes gold, priced in American currency, more expensive for buyers using other currencies. This can reduce demand and, consequently, lead to declining prices.

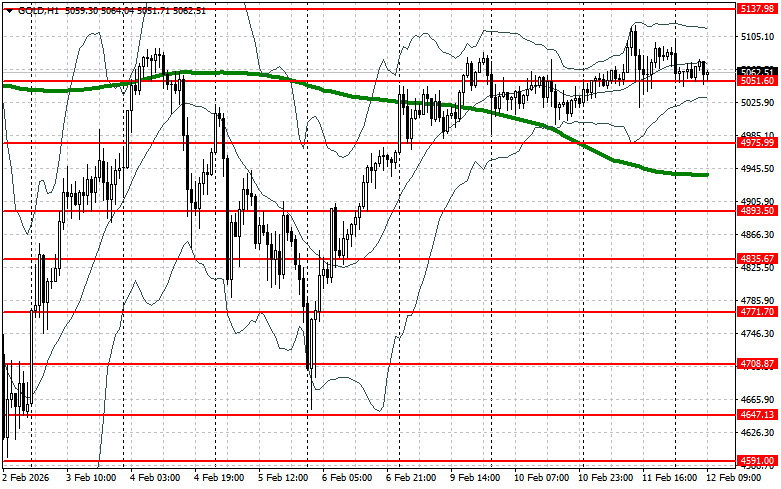

Despite the drop, gold remains above $5000 per ounce. Recall that at the end of January, the precious metal soared to a record high above $5595 before a wave of speculative buying led to overheating in the rally. Subsequently, gold plunged about 13% over two trading sessions.

Many banks anticipate a resumption of the upward trend in gold, as the reasons behind its previous rise remain unchanged—geopolitical upheavals, attacks on the Fed's independence, and capital outflows from traditional assets such as currencies and government bonds. BNP Paribas SA forecasts that by the end of the year, the price of gold will reach $6000 per ounce, while Deutsche Bank AG and Goldman Sachs Group Inc. also have optimistic projections.

Regarding the current technical picture for gold, buyers need to reclaim the nearest resistance at $5137. This will allow targeting $5223, above which it will be quite challenging to break through. The furthest target will be around $5317. In the event of a decline in gold, bears will attempt to gain control over $5051. If they succeed, a breakout of this range will deal a serious blow to bullish positions, pushing gold down to a low of $4975 with the prospect of reaching $4893.