Scheduled Maintenance

Scheduled maintenance will be performed on the server in the near future.

We apologize in advance if the site becomes temporarily unavailable.

Not long ago, Donald Trump could send Wall Street into turmoil with a single social media post. Now, he is threatening to fire the Fed chair and remove the firewall protecting US and global markets, yet equity indices are shrugging off rumors of Jerome Powell's possible resignation. Why? Is it a summer lull? I fear there's more to it. The S&P 500 is acting rationally. It has grown accustomed to the president's eccentricities and sudden pivots. No matter how serious the threats are, volatility continues to decline. There's no fear in the market.

US stocks and bonds volatility trends

The resilience of the broad equity index is admirable, but that cuts both ways. Investors may start to worry that despite a stellar start to earnings season and a surprisingly robust US consumer, the S&P 500 isn't soaring. Instead, it's inching up step by step. Has the good news already been priced in? If so, Bank of America's warning about a bubble may be justified.

The bank notes a major shift in capital flows. In 2024, US equity-focused funds attracted 72% of global inflows. By 2025, that figure had dropped to less than half. Foreign inflows slowed from $34 billion in January to just $2 billion over the past three months. It's no surprise, then, that the S&P 500 is underperforming compared to the global equity index.

S&P 500 and global equity index performance

Rotation plays a key role. The US equity market is still led by the Magnificent Seven. Wall Street analysts expect these companies to post a 14% earnings increase in the second quarter, far outpacing the 3% growth forecast for the other 493 constituents of the S&P 500. Yet even within the group, divisions are emerging.

Tesla and Apple are among the laggards. The latter seems to be sitting on the sidelines, while the rest speed down the AI superhighway. NVIDIA, Microsoft, and Meta are aggressively deploying artificial intelligence technologies. These are the companies currently pulling the broad stock index upward like a growth locomotive.

The S&P 500 also finds support in dovish remarks from FOMC official Christopher Waller, who hinted at a near-term restart of the Fed's monetary easing cycle. Another factor is a Wall Street Journal scoop: Treasury Secretary Scott Bessent is reportedly urging Donald Trump not to fire Jerome Powell. According to him, such a move could rattle markets and face legal hurdles. Besides, why pressure the Fed to cut rates when it already plans to do so twice in 2025?

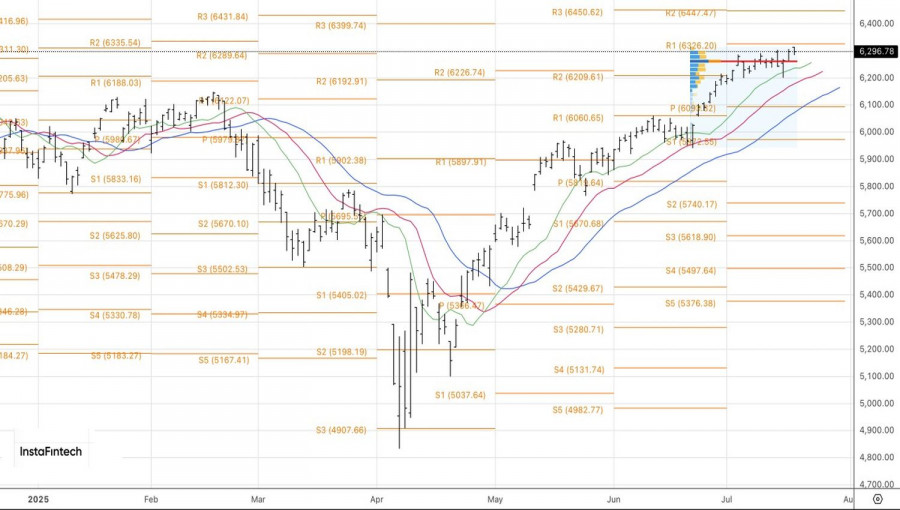

Technically, bulls are running into resistance on the daily S&P 500 chart. A drop below fair value at 6,260 could prompt profit-taking and even a reversal. Until that happens, it makes sense to hold long positions.

Scheduled maintenance will be performed on the server in the near future.

We apologize in advance if the site becomes temporarily unavailable.