The test of the 1.1536 price level coincided with a moment when the MACD indicator had already dropped significantly below the zero mark, which limited the pair's downside potential. For this reason, I did not sell the euro and skipped the entire downward move.

Following statements by Federal Reserve Chair Jerome Powell, the U.S. dollar strengthened. As a reminder, the Fed left interest rates unchanged, and Powell resisted pressure from the presidential administration, ignoring calls from certain committee members to cut rates. Contrary to the expectations of some analysts who anticipated a more dovish tone, Powell's stance supported the dollar on the global stage. Investors interpreted his comments as confirmation of the Fed's intention to combat inflation actively, even at the risk of slowing economic growth. Experts believe this firm approach signals the central bank's independence and its priority of maintaining price stability. The dollar's future trajectory will now depend on incoming economic data and the Fed's ability to strike a balance between fighting inflation and supporting economic growth. Market participants will closely analyze every central bank statement and decision to forecast the future course of monetary policy.

In the near term, the euro may remain under pressure. Negative influence may come from weak inflation data in France and Germany, a rise in German unemployment, and an increase in the eurozone jobless rate. Investors will focus on these key economic indicators. Any unpleasant surprise—such as deterioration in one of these metrics—could trigger a fresh wave of euro selling, as it would heighten concerns about slowing economic growth in the region. The Consumer Price Index, one of the key inflation indicators, will be especially important. Too low inflation could prompt the European Central Bank to reconsider its monetary policy and possibly implement additional economic stimulus measures, putting further pressure on the euro.

A rise in unemployment, particularly in Germany—the largest economy in the eurozone—would be another worrying signal. An increase in joblessness could point to problems in the industrial sector and a decline in consumer activity. These factors could negatively affect economic growth prospects and increase pressure on the ECB to ease monetary policy.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

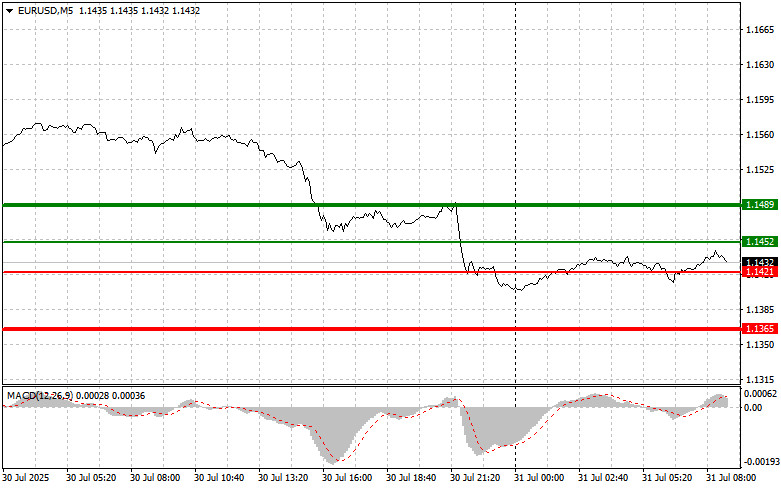

Scenario #1: Today, I plan to buy the euro at a price of around 1.1452 (green line on the chart), targeting a rise to 1.1489. At 1.1489, I plan to exit the market and open a short position in the opposite direction, aiming for a 30–35 pip move from the entry point. A bullish move in the euro should only be expected in the case of strong data.

Important: Before buying, make sure the MACD indicator is above the zero line and just beginning to rise from it.

Scenario #2: I also plan to buy the euro today in the event of two consecutive tests of the 1.1421 level, at a time when the MACD indicator is in the oversold area. This will limit the pair's downside potential and trigger a market reversal upward. A rise to the opposite levels of 1.1452 and 1.1489 can be expected.

Scenario #1: I plan to sell the euro after it reaches 1.1421 (red line on the chart), with a target of 1.1365, where I intend to exit the market and immediately open a long position in the opposite direction (aiming for a 20–25 pip reversal from that level). Downward pressure on the pair may resume at any moment today.

Important: Before selling, make sure the MACD indicator is below the zero line and just beginning to decline from it.

Scenario #2: I also plan to sell the euro today in the event of two consecutive tests of the 1.1452 level, at a time when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downward. A decline to the opposite levels of 1.1421 and 1.1365 can be expected.