What matters more—artificial intelligence technologies, fiscal stimulus, strong corporate earnings, and expectations of a Federal Reserve rate cut? Or tariffs and a cooling U.S. economy? The S&P 500 continues to swing between bullish and bearish drivers, resulting in mixed performance of the broad stock index. While optimism can be priced into equities, the question of whether the U.S. economy is cooling remains unanswered.

The U.S. has unveiled a full list of tariffs, doubling duties on India for buying Russian oil and imposing 100% tariffs on imports of chips and semiconductors. However, Donald Trump made an exception for companies investing in the U.S. economy right after Apple pledged to invest $100 billion. Investors concluded that supply chain disruptions could be avoided and rushed to buy into the S&P 500.

The S&P 500 rally gained even more momentum following dovish remarks from Fed officials. FOMC Governor Lisa Cook called the latest employment report "disastrously bad" and noted that such massive data revisions typically occur during turning points in the U.S. economy. Recall that nonfarm payrolls for May and June were revised downward by 260,000—the largest revision since the pandemic.

San Francisco Fed President Mary Daly stated that the Fed would need to ease monetary policy in the coming months to avoid further cooling in the labor market. Minneapolis Fed President Neel Kashkari said he still expects two rate cuts, and that the slowdown in the economy demands urgent Fed action to adjust rates.

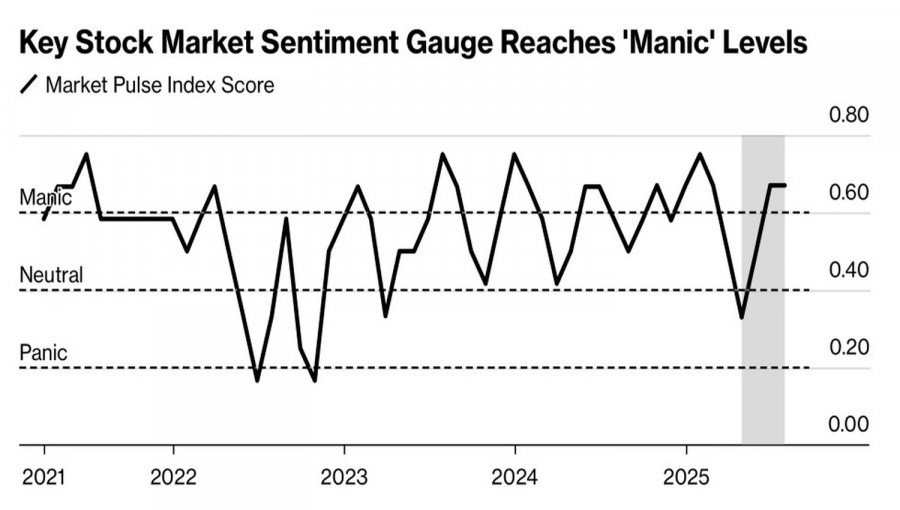

The S&P 500 is focusing on the approaching start of the Fed's rate-cutting cycle and is ignoring the fact that U.S. manufacturing activity has remained below the critical 50 mark since March. It's also overlooking the surge in the Bloomberg Intelligence Market Pulse Index, which has climbed to an extreme level—signaling that stock market returns may soon be limited.

In my view, the foundation of the S&P 500 rally has become unstable. The U.S. economy is beginning to show cracks. Employment and business activity data support this. Corporate earnings may appear strong, but only because initial projections were overly optimistic. At the same time, the stock market is entering a seasonally weak period, which is concerning. Over the past decade, the broad market index has closed in the red five times during this stretch.

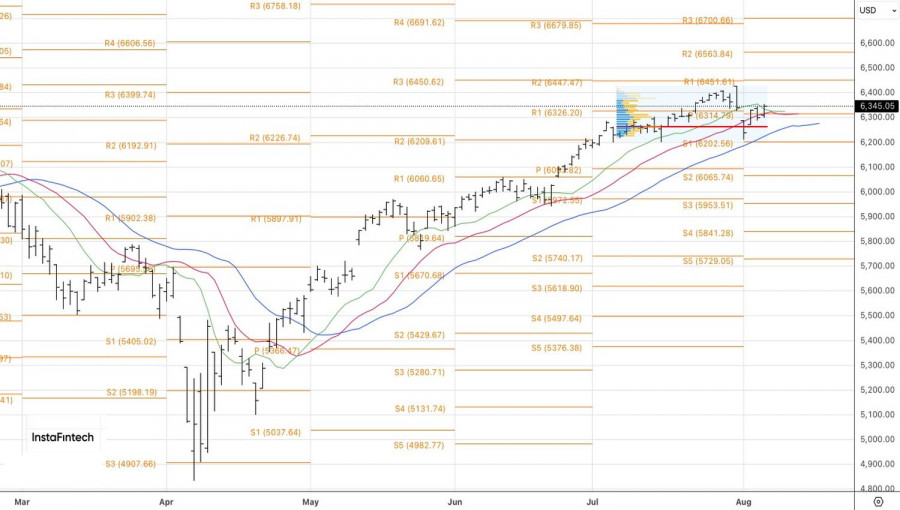

Technically, the S&P 500 daily chart shows ongoing mixed movement. The risk of a 1-2-3 reversal pattern forming is relatively high. Therefore, while prices may still climb slightly, any drop below the support levels at 6325 and 6315 should be viewed as a selling opportunity.