A test of the 1.1718 level coincided with the MACD indicator just starting to rise above the zero mark, which confirmed this as a valid long entry in EUR and resulted in only a 10-pip upward move.

The 0.1% decline in the US Producer Price Index for August triggered a weakening of the dollar and, consequently, a strengthening of the euro. This development came as a surprise to many and forced analysts to reconsider their outlook on the Fed's future monetary policy. However, a major risk asset rally did not materialize—indicating that FX markets remain volatile and uncertain. Market participants are closely watching economic releases from both the US and Europe, trying to anticipate the next moves by central banks.

Today, the ECB will release its key interest rate decision and monetary policy statement in the first half of the day. Shortly after, ECB President Christine Lagarde will hold a press conference. Although rates are expected to remain unchanged, the market's focus will be on any signals and commentary from Lagarde, which could hint at the central bank's future policy path. Investors will scrutinize Lagarde's rhetoric for clues about the ECB's inflation outlook and especially any updates due to the repercussions of Trump's trade policy; such comments may indicate the ECB's readiness (or lack thereof) to act quickly.

The ECB's opinion on the current state of the European economy and risks related to geopolitics, the energy crisis, or supply chain disruptions will also be in focus. Emphasizing these risks could signal a more cautious approach to policy, while optimism would point to more resilience. Finally, market participants will be watching the monetary policy report details, especially any insight into future ECB plans.

As for the intraday strategy, I will focus more on implementing scenarios #1 and #2.

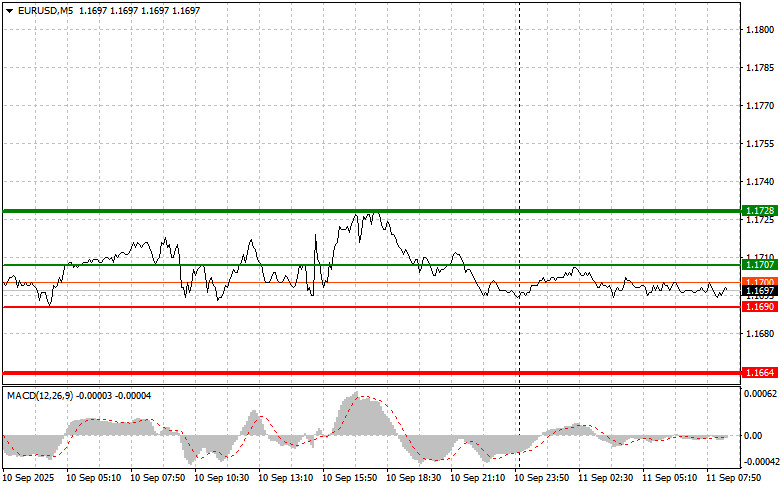

Thin green line – entry price at which the instrument can be bought.

Thick green line – suggested price for taking profit or manually securing profits, as further growth above this level is unlikely.

Thin red line – entry price at which the instrument can be sold.

Thick red line – suggested price for taking profit or manually securing profits, as further decline below this level is unlikely.

MACD indicator: When entering the market, it is important to refer to overbought and oversold areas.

Important. Beginner forex traders should exercise extreme caution when making entry decisions. Before important fundamental reports, it is best to stay out of the market to avoid sharp price swings. If you decide to trade during the release of news, always use stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit, especially if you don't use money management and trade large volumes. And remember: for successful trading, you need a clear trading plan, as I described above. Making spontaneous trading decisions based on the current market situation from moment to moment is a losing strategy for an intraday trader.