Člen bankovní rady Bank of England Alan Taylor v pondělí oznámil, že minulý týden hlasoval pro snížení úrokových sazeb o půl procentního bodu. Toto rozhodnutí bylo v rozporu s většinovým stanoviskem Výboru pro měnovou politiku (MPC). Taylorovo hlasování bylo motivováno současnou „poměrně nebezpečnou“ obchodní situací a oslabující domácí ekonomikou.

Taylor vyjádřil obavy z pokračujícího oslabování důvěry, o čemž svědčí nízké hodnoty indexů PMI a REC. Poukázal na trend preventivního spoření a odkládání investic ze strany domácností a podniků. Své komentáře pronesl během konference pořádané King’s College London.

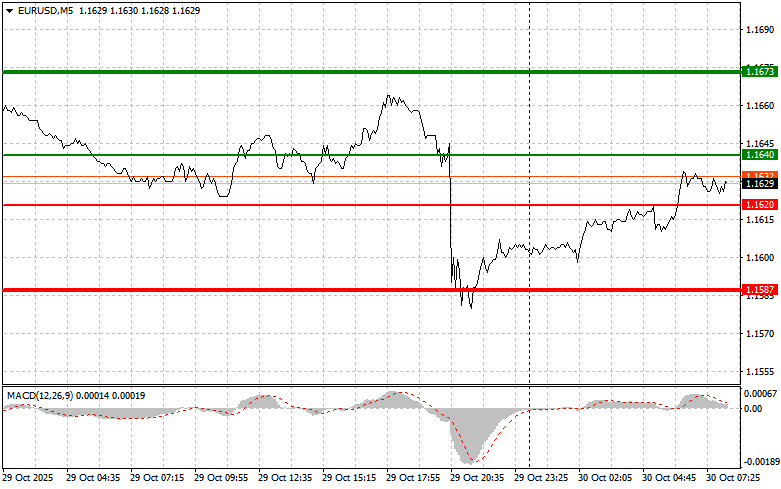

The test of the price at 1.1640 coincided with the MACD indicator just starting to move above the zero mark, confirming a good entry point for buying euros, which led to an upward move of more than 25 pips.

In the context of slowing global economic growth and persistent trade tensions, the Federal Reserve made a decision yesterday aimed at supporting economic growth in the United States. It was expected that the rate cut would reduce the dollar's appeal to investors seeking higher returns in other currencies, but that did not occur. Jerome Powell's speech modified market forecasts. His cautious tone and hint at a pause in the process of rate cuts in the near future restored demand for the dollar. Investors interpreted the signal that the Fed does not plan to continue aggressive rate cuts, despite the pressure the White House administration is exerting on the committee.

Today, attention is focused on the upcoming economic reports for the Eurozone. The market is closely monitoring the forthcoming economic reports from the European region and Germany, as they can significantly influence the short-term exchange rate of the euro. GDP data for the Eurozone will provide an insight into the current economic situation and growth rates in the region. If the actual figures exceed expectations, it may indicate greater economic resilience than previously thought, which, in turn, could support the euro.

The unemployment rate in the Eurozone is also an important indicator. Its decrease is usually interpreted as a favorable sign, indicating an improvement in economic conditions and increased consumer activity. This could enhance the euro's appeal. The consumer price index in Germany is also quite significant. Inflation is one of the key factors the German central bank considers. An increase in the consumer price index could signal a possible tightening of monetary policy by the ECB in the future. Therefore, the combination of today's published data may significantly affect the future dynamics of the European currency. Investors will carefully analyze each indicator to assess the Eurozone's outlook and make informed investment decisions.

Regarding the intraday strategy, I will focus more on implementing scenarios №1 and №2.

Important: Beginner traders in the Forex market need to exercise caution when making entry decisions. It is advisable to stay out of the market before significant fundamental reports to avoid sharp price fluctuations. If you choose to trade during news releases, always set stop orders to minimize losses. Without stop orders, you can quickly lose your entire deposit, especially if you do not employ money management and trade large volumes.

Remember that to trade successfully, you need to have a clear trading plan, similar to the one presented above. Spontaneous trading decisions based on the current market situation are inherently a losing strategy for intraday traders.