The GBP/USD currency pair traded relatively calmly on Tuesday. Recall that last week, the dollar was performing exceptionally well. Initially, the market experienced a sense of euphoria when Donald Trump announced the name of the future Federal Reserve chair. Then, the Bank of England made a neutral decision to keep the key interest rate unchanged, but the Monetary Policy Committee's voting results disappointed supporters of the pound sterling. Both events prompted a decline in the GBP/USD pair, indicating a rise in the dollar. Is this fair?

In our opinion, not quite. As we mentioned earlier, the BoE made a neutral decision to maintain the key interest rate. However, the market still tends to react not to the actual state of affairs but to the relationship of "expectations/reality." Since expectations consisted of only two "dovish" votes out of nine, while in reality, there were four "doves," the pound fell as if struck down.

A very similar picture was observed with Kevin Warsh's appointment. The market long believed that the new Fed chair would be Kevin Hassett or Christopher Waller, both of whom were ready to lower rates to zero. Instead, it would be... Kevin Warsh... an opponent of "soft" monetary policy. Experts quickly dug up numerous interviews with Warsh from his time on the Fed's Monetary Policy Committee and concluded that he is a "hawk." The leading candidate for the position of Fed chair has always been known for his tough rhetoric on monetary policy, opposing the Fed's balance sheet expansion and supporting high interest rates. The market quickly concluded that Warsh would be a worthy replacement for Powell, and the Fed would maintain its independence from Trump.

But why would Trump appoint another person who is not under his control as head of the Fed? Trump needs a puppet who will unquestioningly execute all the orders from the White House. And what these orders will be is easy to guess. For the entire year, Trump openly demanded that the key interest rate be lowered. It all culminated with the president exerting pressure on Monetary Policy Committee officials. Adriana Kugler had to leave her position, and criminal investigations are underway against Lisa Cook and Jerome Powell, which could result in their dismissal.

All of these points indicate that Trump wants control over the Fed. We mentioned on the same day Warsh's candidacy was announced that the newly appointed chair would quickly change his viewpoint. Days later, Warsh stated that he supports further easing of monetary policy. The curtain falls. Thus, the dollar received yet another blow, and the Fed will find itself without a leader starting in May, lacking its spiritual leader who could resist Trump.

Today, the US Non-Farm Payroll and unemployment reports will be released, which could exacerbate the situation for the US currency.

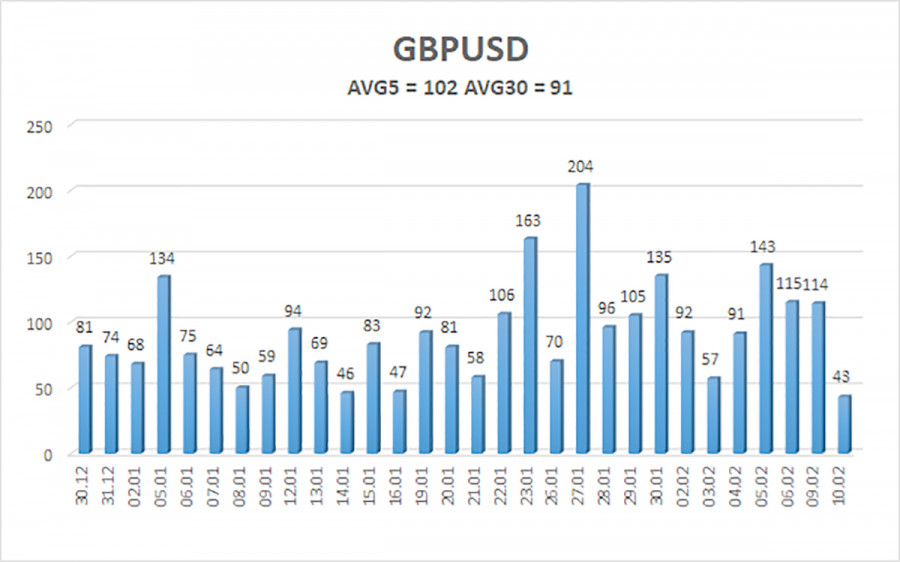

The average volatility of the GBP/USD pair over the last 5 trading days as of February 11 is 102 pips. For the pound/dollar pair, this value is considered "average." On Wednesday, February 11, we thus expect movements within a range bounded by levels 1.3557 and 1.3761. The upper channel of the linear regression is directed upwards, indicating a trend recovery. The CCI indicator has entered the overbought zone six times over the past months. It has formed numerous "bullish" divergences, which have repeatedly warned traders of an impending resumption of the upward trend.

The GBP/USD currency pair is on track to continue its 2025 upward trend, and its long-term prospects remain unchanged. Trump's policies will continue to exert pressure on the US economy, so we do not expect the US currency to grow in 2026. Even its status as a "safe haven" no longer holds significant weight for traders. Therefore, long positions with targets at 1.3916 and above remain relevant for the near term as long as the price is above the moving average. If the price is below the moving average line, small shorts can be considered with a target of 1.3550 based purely on technical (correction) factors. From time to time, the American currency exhibits corrections (on a global scale), but for trend growth, it needs global positive factors.